The Allure of Gold Coins: Why Investing in Gold is a Smart Move

In the realm of investments, few assets carry the same weight, both literally and figuratively, as gold coins. These shiny, precious symbols of wealth have been a cornerstone of human commerce for thousands of years, transcending various economic epochs. As we navigate through a tumultuous economic landscape, where uncertainties abound, investing in gold coins has surged in popularity among savvy investors and novices alike. In this comprehensive article, we will explore the intricacies of gold coins, their history, their benefits, and how they fit into the broader context of bullion investment.

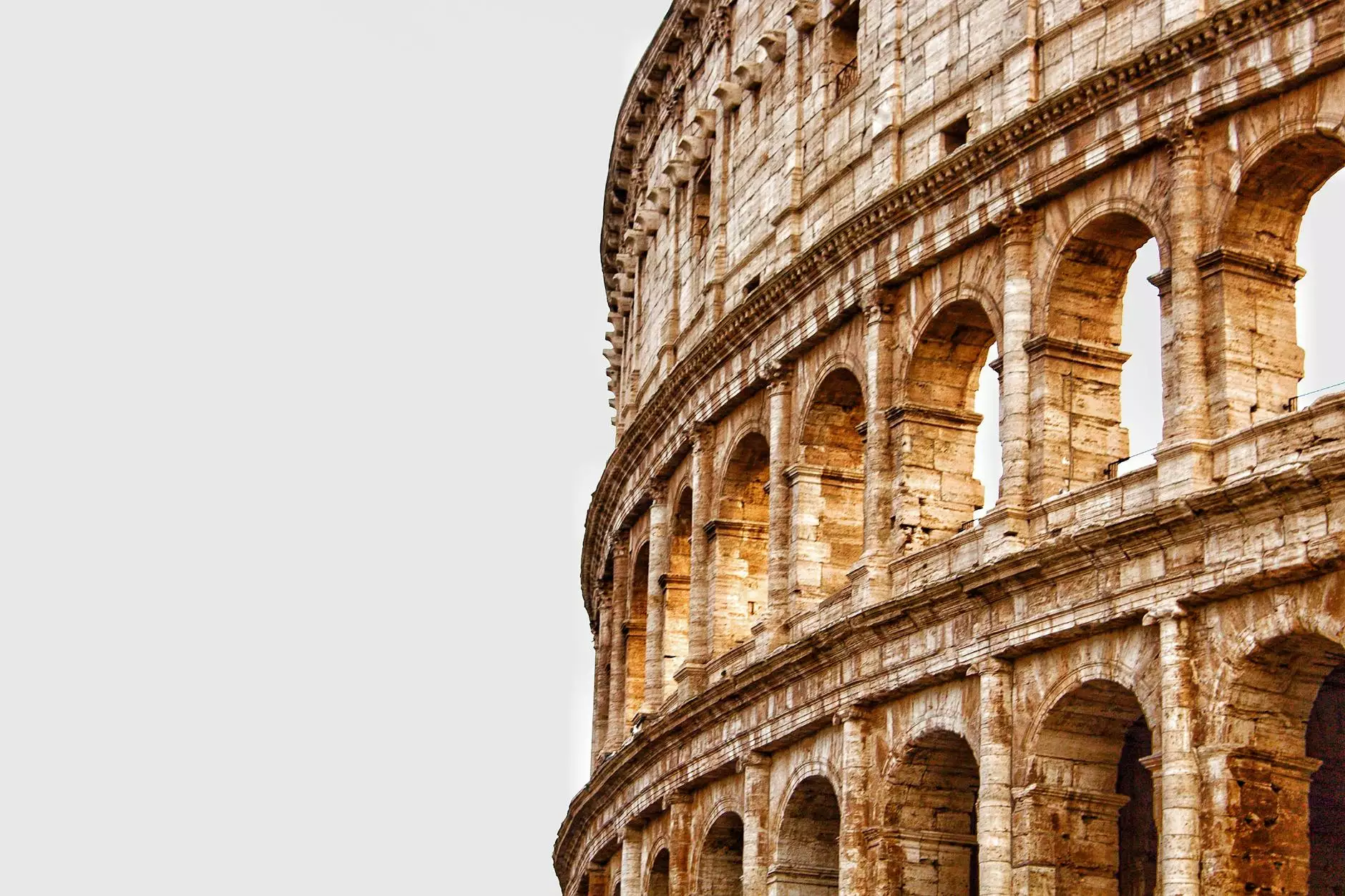

The Historical Significance of Gold Coins

The journey of gold coins dates back to antiquity, where they served as a standard medium of exchange. The first known coins were minted in Lydia (modern-day Turkey) around 600 BC, marking the genesis of standardized money. Gold coins represented not just currency but also status and stability. They were utilized by various civilizations, such as the Roman Empire and the Byzantine Empire, as symbols of wealth and powerful empires.

Gold Coins Through the Ages

- Ancient Civilizations: Egyptians, Greeks, and Romans used gold coins not only in trade but also to showcase their affluence.

- Middle Ages: During this period, gold coins were the primary medium for trade across Europe, solidifying their value.

- Modern Era: While the world moved to paper currency, gold coins still retained an important place in numismatics and investment.

Today, gold coins are not only used by wealthy individuals as a form of currency but also emerged as a viable investment option that complements a well-rounded portfolio.

The Investment Appeal of Gold Coins

One may wonder, what makes gold coins such an attractive investment choice? The answer lies in a myriad of factors that contribute to their enduring appeal:

1. Tangible Asset

Unlike stocks or bonds, which exist only as digital entries, gold coins are physical assets. Owning a tangible item instills a sense of security. During financial crises or economic instability, people instinctively turn to precious metals like gold for protection against inflation and currency fluctuation.

2. Liquidity

Gold coins enjoy incredible liquidity. In any corner of the world, an investor can easily sell their gold coins for cash without hassle. They are widely accepted and traded, making it simpler to convert to currency when needed.

3. Portfolio Diversification

A well-balanced investment strategy requires diversification. Integrating gold coins into your portfolio provides a level of protection against market volatility. Historical data showcases that gold often moves inversely with stock markets. Hence, during economic downturns, when stocks diminish in value, gold typically appreciates, offering a safety net for investors.

4. A Hedge Against Inflation

Inflation erodes purchasing power, and currencies fluctuate with the economy. However, gold, especially in the form of gold coins, is often seen as a hedge against inflation. Over long periods, gold has maintained its purchasing power and consistently rises in value during inflationary periods.

Types of Gold Coins to Consider

When approaching the investment market for gold coins, one should be aware of the various types available. Different gold coins come with unique characteristics and potential benefits.

1. American Gold Eagle

The American Gold Eagle is one of the most popular gold coins available today, produced by the United States Mint. It is highly regarded for its purity and recognition. These coins are minted in various denominations, with the one-ounce coin being the most sought after.

2. Canadian Gold Maple Leaf

Produced by the Royal Canadian Mint, the Gold Maple Leaf is another favorite among investors. Renowned for its remarkable purity (99.99%), it features a distinctive maple leaf design on one side and the image of Queen Elizabeth II on the other.

3. South African Krugerrand

The Krugerrand made history as the first gold coin ever minted with a one-ounce gold weight. It is recognized globally and has been a symbol of quality and value for decades.

Buying Gold Coins: What To Know

Acquiring gold coins requires a certain level of knowledge to ensure sound investment. Here are critical factors to consider:

1. Understand the Market

Before making a purchase, take time to understand the gold market. Track prices, stay informed about economic news, and be aware of supply and demand factors that affect gold pricing.

2. Buy from Reputable Dealers

Always purchase from established and reputable dealers. Websites like donsbullion.com showcase a wide range of precious metals, including gold, silver, platinum, and palladium. Check for credentials, online reviews, and any signs of trust signal before you commit to a purchase.

3. Assess Purity

Not all gold coins are created equal. Ensure that the coins you are purchasing are verified for purity. Look for coins with a certification from a trusted grading service.

Maintaining Your Investment in Gold Coins

After investing in gold coins, maintaining the condition and safety of your investment is paramount. Here are some practical tips to consider:

1. Proper Storage

Store your gold coins in a secure environment. Options include safe deposit boxes, home safes, or specialized storage facilities for precious metals. Ensure they are kept in a way that prevents any physical damage or deterioration.

2. Regularly Assess Value

Monitor the value of your gold coins periodically. As gold prices fluctuate due to market conditions, understanding your asset's current value can inform investment decisions and timing for selling.

3. Insurance Considerations

Consider insuring your collection of gold coins to protect against theft or damage. Consult with an insurance agent who specializes in collectibles to secure appropriate coverage.

Conclusion: The Future of Gold Coins in Investment

In conclusion, it is clear that gold coins are more than just shiny collectibles. They are a robust investment choice with a rich history and promising future. As we continue to face economic uncertainties, gold coins provide an avenue for wealth preservation and an opportunity to diversify portfolios. Platforms like donsbullion.com offer fantastic options for both seasoned investors and newcomers looking to explore the benefits of investing in gold and other precious metals.

As you contemplate your investment strategy, consider the unparalleled stability, liquidity, and historical significance of gold coins. By understanding the market, buying wisely, and maintaining the value of your investment, you can enjoy the myriad advantages that come along with this timeless commodity.